The perfect partnership of Mutual Funds and Wealth Management

“Life is a series of experiences, each of which makes us bigger, even though it is hard to realise this. For the world was built to develop character, and we must learn that the setbacks and griefs which we endure help us in our marching onward.” — Henry Ford (1863-1947)

Today we stand at an interesting juncture in our socio-political and economic journey as a country. With an overwhelming population of young (around 60% of our teeming millions are below the age of 25) and a large grey economy, we are a country which has tremendous savings potential, yet untapped and underrepresented in the deposit base. In addition to the absence of a saving culture and lack of real saving avenues, a majority of the people, even those employed in the corporate sector, don’t have access to retirement planning or pension savings.

The entire financial services industry has recognised that savings growth through expansion of the retail saver/investor is the way forward and that this will provide the bedrock for creation of wealth and capital formation in days to come.

As service levels increase in the banking sector, the retail depositor wants greater client-centricity, expects ease in transactions, best possible returns as well as multiple investment avenues to choose from. Commercial banks now have the challenge of providing holistic customised solutions to the depositors, while dealing with other challenging tasks such as expanding the low cost deposit base, reducing NPLs and countering the pressure of shrinking spreads in a decreasing interest rate scenario. The revenue race, and bottom line growth expectation year on year, is driving banks to think of other avenues for increasing fee based income. Apart from these challenges, ensuring efficient and cost effective transactional experience for depositors through cutting edge technology as well as operational systems is also becoming imperative.

Commercial banks face a daunting, question today i.e. how to retain and grow their client base which on the one hand is highly aware and lacks brand loyalty due to expectations of higher returns, and on the other hand also expects high levels of ‘personalised’ advice in achieving its financial goals. The writing is on the wall, Wealth Management offering various investment solutions including Mutual Funds is the way forward for local commercial banks.

The most common way to save currently is to put money into bank deposits, but truly speaking, in the medium to longer run, this does not even cover inflation or the Pak Rupee devaluation that occurs, leaving most of us wondering how we would be fulfilling our larger needs and wants.

Enter Mutual Funds and Wealth Management:

Luckily for our generation and those after us, Mutual Funds have emerged in our financial services as an ideal vehicle for promoting savings. These form the substratum of Wealth Management and advisory services internationally and the trend is now appearing in our commercial banking environment where Wealth Management has become a way of providing bespoke investment solutions to retail depositors.

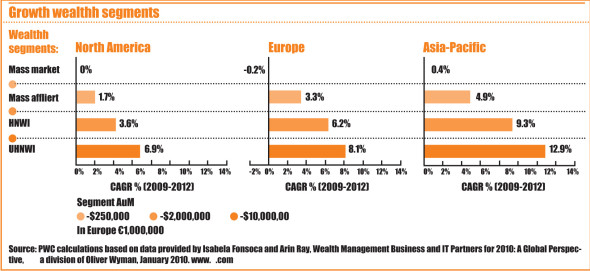

Wealth Management has been largely untapped in Pakistan as banks have ventured tentatively into this area and have not really made it a success story in the past. In fact, most banks are yet to have a Wealth Management function. But the good news is that we can learn from the mistakes and the success stories of other countries where Wealth Management has flourished. During the period, 2008-2012, Asia Pacific has gained great significance in financial advisory services and Singapore has emerged as the most formidable force and a veritable financial advisory hub.

In this piece I will attempt to draw parallels from the Mutual Funds distribution growth story in Singapore, so that we can learn from these, adapt and apply them here to our Pakistani context. I believe that rather than creating a pedantic piece, merely stating academic truisms, it would be more meaningful to make Singapore a case study from which we can draw experiential lessons and conclusions, which can benefit banks and Asset Management Companies (AMCs) alike and aid Pakistan’s nascent Wealth Management sector.

Scanning the two landscapes:

Pakistan’s Wealth Management industry (as a subset of the entire financial services industry) is indeed in its infancy. Even though, as the poet concedes, we have “miles to go before we sleep”, perhaps it would be fruitful to identify and chart out the route we should take and to determine what milestones we need to cross.

In Pakistan, the Asset Management Industry was established in 1962 with the birth of National Investment Trust (NIT), its first fund being an Equity Fund namely National Investment Unit Trust. However, it was not until 1995 that the first private sector AMC that actively catered to institutional and retail investors, was established with the launch of JS Investments Limited (JSIL) (previously ABAMCO) followed by Al Meezan Investment Management Limited, the first and only Shariah Compliant Asset Management Company.

Meanwhile in 1995 the Asia Pacific industry comprised mainly of Mutual Funds from Hong Kong, Taiwan and Singapore. In Singapore, locally managed Mutual Funds were being primarily distributed by financial advisory firms and select private banks. They were also offered by a smattering of multinational/US-owned broker/dealer securities companies though they did not have significant market share and were not necessarily focused towards Mutual Funds, instead they were being offered as an additional product to complete their suite of financial services provided to their investors.

Similar to the Pakistani commercial banks today, at that time, Singapore’s local banks had a significant retail network and client base The commercial banks were quick to recognise this opportunity and turned to their own fund management companies for providing investment solutions that their customers could utilise as a means for savings at higher returns. They used their own footprint to distribute these Mutual Funds to their retail client base and wealthier depositors, thus enhancing the bank’s product suite and deepening their outreach.

By the year 2000, all major retail banks in Hong Kong and Singapore had come into the Wealth Management arena and had become champions of retail distribution for Mutual Funds by way of their Wealth Management services. Commercial banks were able to capture 85% of the market share, whereas previously they had accessed no more than 15%.

A leap forward in terms of regulation for the Mutual Fund industry Singapore occurred in 1997 when its apex regulator, the Monetary Authority of Singapore (MAS), allowed foreign /offshore fund authorisation observing the change in the region. This triggered the “offshore funds” boom. Under the new regulatory regime Singapore based Asset Management “feeder funds” could now invest into SICAVs or Luxemburg based offshore funds and also be distributed locally. In the next period, between 2000- 2005, retail investors benefitted from Mutual Fund investments as a means to grow their savings and achieve their financial goals, through the convenient and familiar platform of their commercial banks.

In Pakistan even though regulation may not have evolved as much, the Mutual Fund industry certainly had established its roots and the period from 2002 to 2007 was indeed a boom era with all leading commercial banks launching their AMCs and by June 30th, 2008 the total Assets Under Management (AUM) were Rs. 338 billion. Another positive development during the same period was that commercial banks such as MCB Bank, UBL and Meezan Bank commenced (some with greater focus and others with lesser success) leveraging their branch network to distribute their proprietary (own AMC) funds through select branches. Also multinational banks with regional offices in Singapore, such as Standard Chartered Bank, took on distribution and started offering third party Mutual Funds to their High Net Worth (HNW) clients.

At the same time, in Singapore, during this period, commercial banks developed open architecture platforms and started offering Mutual Funds of a number of different fund houses, because the customer wanted a spectrum of investment options, which they were not able to provide when offering only proprietary funds. This was a profitable proposition for the banks. Commercial banks acting as distributors, being larger volume players, took the entire front-end load for funds (5% usually) and a significant proportion of the annual management fee (on average 50bps) from AUM. This incentivised the banks to expand their Wealth Management arms. The private banks, that commenced distribution of Mutual Funds earlier were the hares in this race while consumer banks turned out to be the tortoise and were the winners, hands down. (A ballpark estimate for Asian commercial banks is that by 2005, on average 10% of their total revenue emanated from the Mutual Fund distribution through Wealth Management.)

The global financial crisis of 2008 had left its mark on the Singapore market, however it had already established itself as a financial advisory hub. As the Singapore economy recovered, its Wealth Management, being fed by the Mutual Fund industry, bounced back rapidly. Switching back to Pakistan, in 2008 the capital markets crisis took a toll on the industry and the total AUM declined to Rs 206 billion by June 30th 2009.

Today, the Pakistan Asset Management industry has recuperated with greater focus on low risk and liquid funds. Some investors with greater risk tolerance have enjoyed the superior performance of the equity market funds over the period 2011-1012. The industry now stands at total AUM of Rs. 359 billion as of 31st May, 2013 divided between twenty four companies. The industry focus has now shifted to individual or retail investors as opposed to institutional investors with most AMCs working actively to spread their retail outreach.

Now the next level:

The timing is opportune for the Pakistan financial services industry to expand on the Wealth Management and advisory side, as there is a clear convergence in the vision of both commercial banks and AMCs regarding the importance of the retail client base. Our retail investors can best be provided multifarious Mutual Funds with better returns, long term options to meet their financial goals and needs. Further, it appears that the macro-economic environment in our country is also quite conducive and may remain so for some time to come as interest rates remain low and the inflationary trends continue based on the upward pressure posed by oil and energy expenditure. As commercial banks would be seeing their margins squeezed and competing for a limited pie of current & savings accounts, services earning fee based income will become more important. This end would be most effectively reached through the means of distributing Mutual Funds, including pension schemes by way of Wealth Management. This makes even more sense as all the major banks, namely, MCB Bank, Habib Bank Limited, United Bank Limited, Meezan Bank, Bank Al Habib, Bank Alfalah, Askari Bank, JS Bank and Faysal Bank, all have their own subsidiary AMCs. These can provide them feeder funds and banks can also explore open architecture platforms with at least a certain segment of third party or specialised funds available for their customers. Going forward Wealth Management desks would have to work towards operating as one stop shops and offer Mutual Funds and other financial products from various companies to provide clients with the required diversity and options. This would be a win-win for the banks, the AMCs and the clients. The growth of deposit base of individuals in Pakistan in the past 5 years is a strong indicator of the potential of Wealth Management.

Source for numbers used in graph: State Bank of Pakistan official website

Pakistani banks can tap into regional wealth, such as from white collar workers in the UAE and other parts of the Middle East, by having mutual fund managers create remittance linked products through sophisticated feeder funds located locally or offshore. A country that receives US $14 billion in remittances can benefit from such investment solutions that serve as receptacles for this currency inflow. This would require effort on the regulatory front as well as product innovation to ensure that the right investment avenues with the requisite features are offered to Non-Resident Pakistanis. Again, this would be a beneficial arrangement for all stakeholders and hence regulatory support should be forthcoming.

Synergies can also be explored within the client base as HNW are often times business owners, land owners, traders, or senior management of large corporations and can avail many other banking services allowing a more holistic relationship and ensuring greater ease through a one stop shop experience in financial services. This will also ensure greater customer loyalty and retention in these competitive times for banks branches in urban centres. It goes without saying that this proposition of course would not be that attractive in the rural or remote areas.

The moral and the ethics of the story:

The secret ingredient for the success of these distribution initiatives is obtaining the investor’s trust. For this, the highest ethical standards are imperative on the distribution front as well as in investment management. Further, we would have to develop a pool of well trained professionals who are skilled, aptly qualified/certified for the investment advisory function, and have unquestionable integrity and ethics. Providing Wealth Management and investment advisory services requires many different aspects, such as correctly ascertaining the clients’ financial needs and goals, understanding their risk tolerance, offering them appropriate products and investment solutions, managing the sensitive risk-reward balance, having a grasp on the regulations, understanding impact on investor of changes in regulation and last but the most important is building a long term relationship based on trust and confidence of the client.

We can soar to new heights if we take the direction of those before us who have succeeded, namely Singapore. However, this is going to be a process which will require an enabling environment from the regulatory point of view as well as from the market players, in this case the commercial banks. Before we fly however, it is essential that we learn to take unfaltering steps of our own volition.

“He who would learn to fly one day must first learn to stand and walk and run and climb and dance; one cannot fly into flying.” — Nietzsche. In Pakistan Mutual Funds and Wealth Management of banks must start their partnership journey right now, so that together they may truly take flight and soar the skies of the financial services industry very soon….